Expected Goals (xG) Models

Footballxg provides hundreds of data points in an easy to analyze Excel format. We (Footballxg.com) have created a number of proprietary models to predict the outcome of football matches. What sets us apart from other offerings in the market, is our models use Expected Goals (xG) data which has more predictive power than using actual goals alone.

Please be aware that multiple websites will claim to have an xG Model but nearly all are based off actual goals or shots.

The below analysis provides a summary of the xG model along with the historical profitability. Common questions are also covered.

How profitable are they?

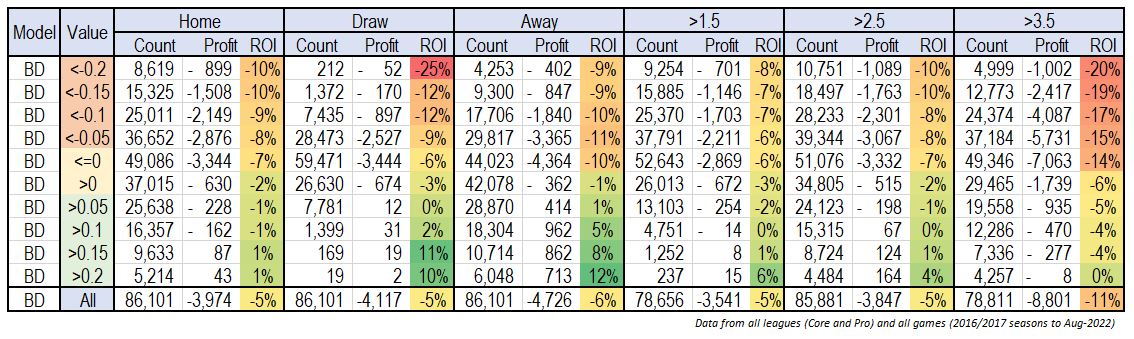

Below is the output across all leagues (Core and Pro) for the Blend model. It is broken down by the various value bands in 5% increments e.g. >0.1 shows all games where the model was showing 10% value (reminder: Value Calculation = Poisson Model Output (minus) 1/Opening Odds).

Common Questions?

The ROIs are low?

That is correct. Even the best minds in football betting struggle to make double digit ROIs. It is a long hard grind to be profitable and a constant fight trying to find value. There are plenty of people out there who will promise amazing profits but you’ll soon find out that nearly all of these fit into the following buckets: reliant on short-term results, no verifiable long-term record, results based on odds that are not obtainable.

Be warned that historical profits are not a guarantee of the future, and backfitting should be avoided (i.e. removing all unprofitable leagues and odds ranges without justification to enhance ROI). The focus should always be on beating the closing price to achieve consistent and profitable results (see next question below).

Why are you using Pinnacle Opening Odds?

Pinnacle is seen as the best bookmaker for providing prices that are close to a true fair price (when converting odds to fair percentages). That is why beating the Pinnacle closing price is seen as the gold standard.

The reason we use opening odds and not closing odds, is the objectives of the website is to try and beat the closing price. As such, the push is to get trades on as early as possible when the markets are at their most inefficient.

As soon as you get to kick-off time, the market prices will be a lot more accurate that any of our models (especially in the large liquid European leagues). If you are one of those people who only bet just before kick-off, you will find it almost impossible to be profitable long-term (due to the overround, you’re long term-profitability will be a loss).

As Opening Odds are only available at opening , how do you actually bet at opening odds?

In short, you will not be able to bet at exactly the opening odds but it allows a consistent point to measure profitability against (as opposed to picking some max odds number that makes everything look better than it actually is). The opening odds then provide a guide on odds you should be looking to obtain (market moves, historical H2H odds should be other factors to consider when deciding which direction the odds are likely to move (NB: predicted tissue odds based off H2H and prior odds move trends are provided as part of Pro data)).

The other point to note, as shown by the ‘All’ row in the profits table, there is a large overround based on opening odds. As such, if you are able to use an odds comparison website (I personally recommend OddsPortal – zero affiliation before someone asks!) there is a good chance you can get prices in excess of the opening. To caveat that (for the ‘yeah…but…’ community), if you are constantly using soft bookmakers to bet at prices better than Pinnacle your accounts will not last long. They will know that you will be profitable long-term and will not want you as a customer.

If I constantly bet at 10% value per the model, why am I not getting an average of 10% value on my bets?

A good question with multiple reasons:

- First point to note is that value and ROI are two different concepts (see next question).

- Second, the models are predominantly based off Expected Goals (xG) and do not take account of every single factor that would lead to a true value being known. As such, the models are an estimate of value, and do not represent actual value (it is impossible to know with certainty what the fair % chance is).

- Third, as mentioned in the prior question, you are unlikely to be able to get actual opening odds. As mentioned previously, the focus should always be on trying to beat the fair closing odds and keeping records to track your expected returns (see next question also).

- Fourth, the value calculation compares the model value to actual odds (overrounds should be removed to assess actual value. NB: overrounds are removed from closing odds in Pro data to allow assessment of odds obtained to actual fair value odds).

- Finally, historicals are not always a predictor of the future and even if you are getting genuine value on every bet you can still be losing in the short to medium-term due to variance (think betting on heads at 2.5 and getting 10 tails in a row).

How do I know how much I should be making and whether I’m being lucky or unlucky?

- Let’s provide a theoretical example with the usual example of a coin toss. Without a complex model, we know the fair model probability will be 50% for heads. The market odds are giving heads a 40% (2.5) chance which would be equivalent to 10% value in the model (50% model – 40% market). If we place this bet 2000 times, we’d expect to make a profit of 500 (based on 50% fair value, we’d win c.50% of time = [(2.5-1)*1000 for the wins] + [-1*1000 for the losses]. As such, the expected ROI would be 25% (500 profit /2000 bets).

- To simplify, divide your odds by the fair market closing odds (with overround removed) and then minus 1. This will provide a good indication of how much profit per trade you should expect (e.g. (2.5/2) -1 = 0.25). This can then be compared to your actual profit over the long-run. Due to football closing prices not being known for certain (unlike the coin toss), the expected profit cannot be known for sure but it will provide a good guide.

If the models and data are so great, why are you providing them to other people and not keeping the edge for yourself?

First, just because the model is showing value, it is not a guarantee of value (there are many other factors e.g. team news, injuries) that are not modelled and will have large impacts on the price. The models are a data point to be considered when weighing up all other information (e.g. known injuries, local rivalries). As such, the models should be used as the starting point and not the end point. The exact systems and betting strategies we are using are not listed but we are using exactly the same data that is being published on the website.

The other point is due to variance. You can be doing everything perfectly and still have large losses over the short to medium term. If the website generates a profit (FYI – data feeds are not cheap!) then this will help provide a more reliable revenue stream in addition to the large (often stressful) profit swings from betting/trading.

As you have the data, can’t you just front-run (place bets before releasing the data to everyone)?

Linking to the question above, even if we wanted to front-run trades there is very limited liquidity early on to be able to do this. Second, all the future data is provided in the excel files. As such, people could actually front-run us if they pull odds before we do on Tuesdays and Fridays. As such, front running is more of a concern for us than it should be for you, but due to the liquidity point we don’t see it as being a concern at this stage. If subscribers ever get to a significant number where we can see prices are being impacted, then we will have to start restricting numbers.

Other questions?

Hopefully the above shows we’re trying to be as transparent as possible. In summary, the models are a help but do not guarantee easy riches. There are probably a thousand questions that are not covered so feel free to reach out via X/Twitter or via the contact page on the website.